Printable 50 30 20 Rule

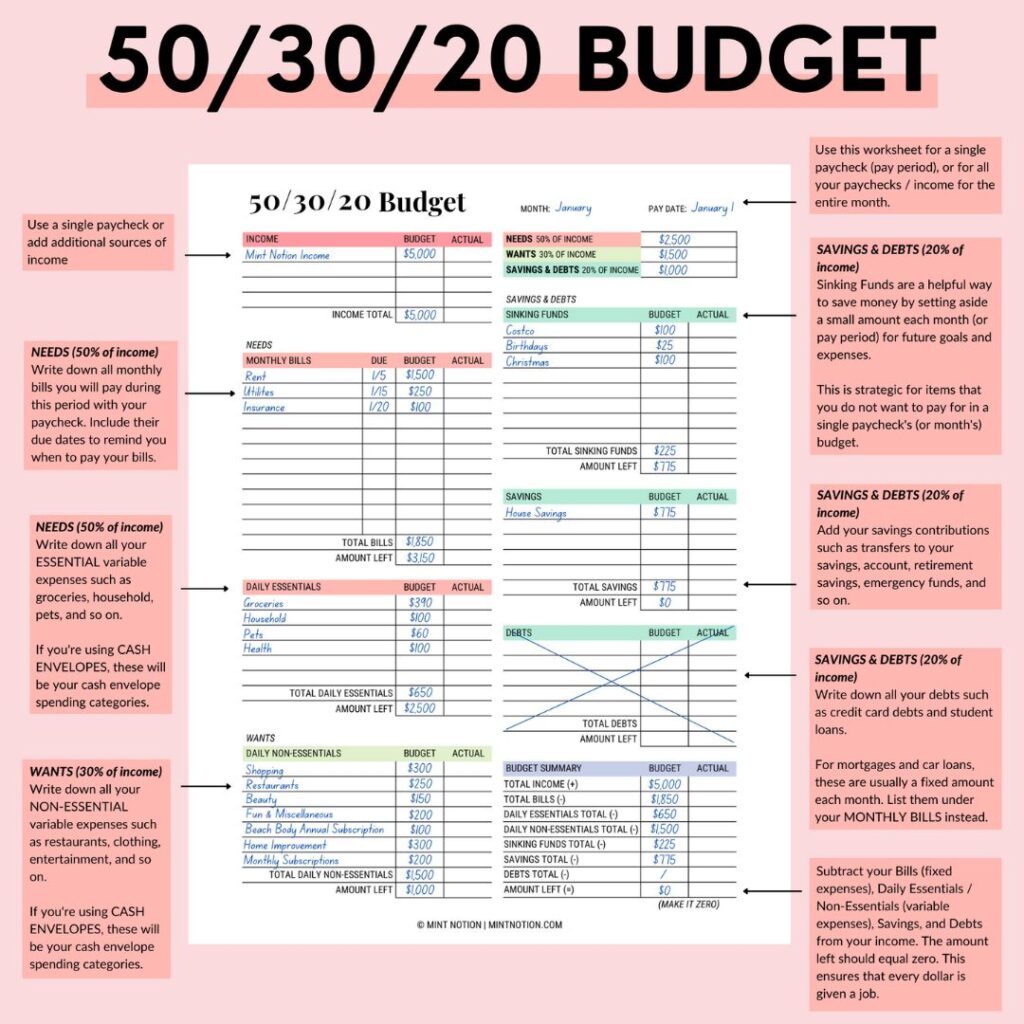

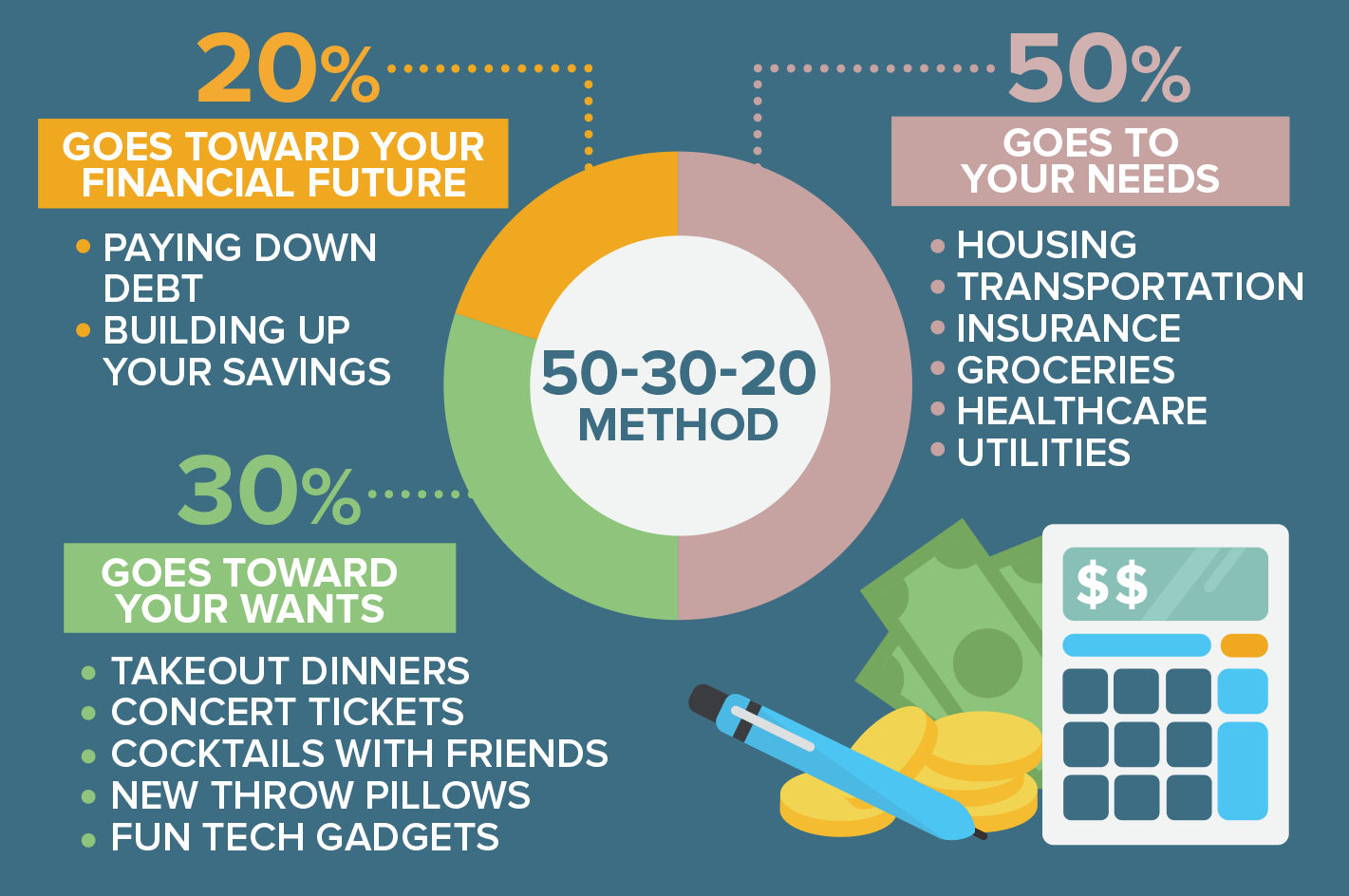

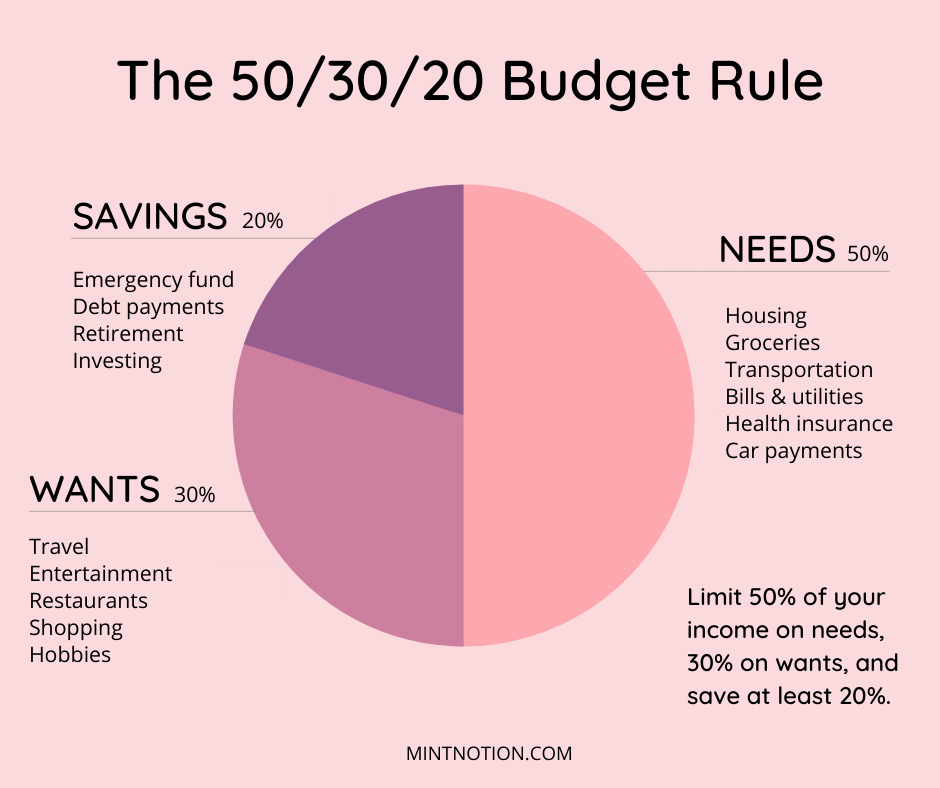

Printable 50 30 20 Rule - This constitutes 100% of your net income. So, what are the rules for setting up a 50/30/20 budget template? To start with, you’ll need to know your monthly income after taxes and deductions. For instance, someone earning $3,000 monthly would allocate $1,500 to needs, $900. Struggling to manage your finances? Track and visualize your income and spending for an average month to see how it compares to an ideal budget. Track the ratio of your savings in your budget. It is a convenient and clear tool for simplifying the budget planning process. Determine how you are going to track your budget and finances. Here’s how you can break down your income: 50/30/20 simple budget template in excel. Consider practical examples to see how the 50/30/20 rule can be adapted to various income levels. Input your income, wants, and needs. For instance, someone earning $3,000 monthly would allocate $1,500 to needs, $900. Designate 50% of your income to needs (mortgage/rent, utilities, car payments), 30% to wants. Learn the basics of this budgeting method including examples! Take control of your finances with the 50/30/20 budget free google sheets template. Simply input your income, and the sheet will calculate exactly where. So, what are the rules for setting up a 50/30/20 budget template? It is a convenient and clear tool for simplifying the budget planning process. Struggling to manage your finances? Here’s how you can break down your income: Track and visualize your income and spending for an average month to see how it compares to an ideal budget. In this post, you’ll find five pretty & practical printables to create your. The 50/30/20 budgeting rule is a popular method that helps you save, invest, and. 50/30/20 simple budget template in excel. For instance, someone earning $3,000 monthly would allocate $1,500 to needs, $900. Take control of your finances with the 50/30/20 budget free google sheets template. It’s perfect if you’re looking for an easy budget strategy or new to budgeting. Track and visualize your income and spending for an average month to see how it. If you earn around $4,960 per month, you can effectively manage your finances using the 50/30/20 budgeting rule. I’ll break it down for you here. It is a convenient and clear tool for simplifying the budget planning process. Track the ratio of your savings in your budget. You limit fixed expenses to 50% of income, save 20%, and can spend. So, what are the rules for setting up a 50/30/20 budget template? Take control of your finances with the 50/30/20 budget free google sheets template. The 50/30/20 budgeting rule is a popular method that helps you save, invest, and enjoy some of the finer things in life. Struggling to manage your finances? The 50/30/20 rule is just one of these. The 50/30/20 budgeting rule is a popular method that helps you save, invest, and enjoy some of the finer things in life. Determine how you are going to track your budget and finances. Designate 50% of your income to needs (mortgage/rent, utilities, car payments), 30% to wants. Take control of your finances with the 50/30/20 budget free google sheets template.. Track and visualize your income and spending for an average month to see how it compares to an ideal budget. This constitutes 100% of your net income. All you do then is put 50% of that amount toward. In this post, you’ll find five pretty & practical printables to create your. So, what are the rules for setting up a. Track the ratio of your savings in your budget. 50/30/20 simple budget template in excel. If you earn around $4,960 per month, you can effectively manage your finances using the 50/30/20 budgeting rule. You limit fixed expenses to 50% of income, save 20%, and can spend the remaining 20%. Designate 50% of your income to needs (mortgage/rent, utilities, car payments),. For instance, someone earning $3,000 monthly would allocate $1,500 to needs, $900. It is a convenient and clear tool for simplifying the budget planning process. Simply input your income, and the sheet will calculate exactly where. 50/30/20 simple budget template in excel. To start with, you’ll need to know your monthly income after taxes and deductions. This constitutes 100% of your net income. The 50/30/20 budget is a simple budgeting method. Track the ratio of your savings in your budget. Track and visualize your income and spending for an average month to see how it compares to an ideal budget. All of your expenses and savings. Learn the basics of this budgeting method including examples! It is a convenient and clear tool for simplifying the budget planning process. The 50/30/20 budget is a simple budgeting method. So, what are the rules for setting up a 50/30/20 budget template? In this post, you’ll find five pretty & practical printables to create your. I’ll break it down for you here. The 50/30/20 budgeting rule is a popular method that helps you save, invest, and enjoy some of the finer things in life. Designate 50% of your income to needs (mortgage/rent, utilities, car payments), 30% to wants. Here’s how you can break down your income: This constitutes 100% of your net income. You break your take home pay down into percentages for your different types of expenses. All you do then is put 50% of that amount toward. It’s perfect if you’re looking for an easy budget strategy or new to budgeting. It is a convenient and clear tool for simplifying the budget planning process. Determine how you are going to track your budget and finances. Input your income, wants, and needs. You limit fixed expenses to 50% of income, save 20%, and can spend the remaining 20%. The 50/30/20 rule is just one of these popular rules of thumb. 50/30/20 simple budget template in excel. So, what are the rules for setting up a 50/30/20 budget template? Struggling to manage your finances?503020 Budget Rule How to Make a Realistic Budget Mint Notion

50/30/20 Budget Template 5 Cute (&Free!) Budgeting Planners

503020 Budget Template

How To Calculate 50 30 20 Rule

Enjoy Budgeting With the 503020 Rule Investdale

Printable 50 30 20 Rule

Printable 50/30/20 Budget Template

503020 Budget Rule How to Make a Realistic Budget Mint Notion

Fillable 50/30/20 Rule Budget Planner Printable 50/30/20 Etsy

50 30 20 Budget Printable 50 30 20 Budget Easy Monthly Budget Tracker

Track And Visualize Your Income And Spending For An Average Month To See How It Compares To An Ideal Budget.

Learn The Basics Of This Budgeting Method Including Examples!

Consider Practical Examples To See How The 50/30/20 Rule Can Be Adapted To Various Income Levels.

For Instance, Someone Earning $3,000 Monthly Would Allocate $1,500 To Needs, $900.

Related Post: