Free Printable Transfer On Death Deed Form Florida

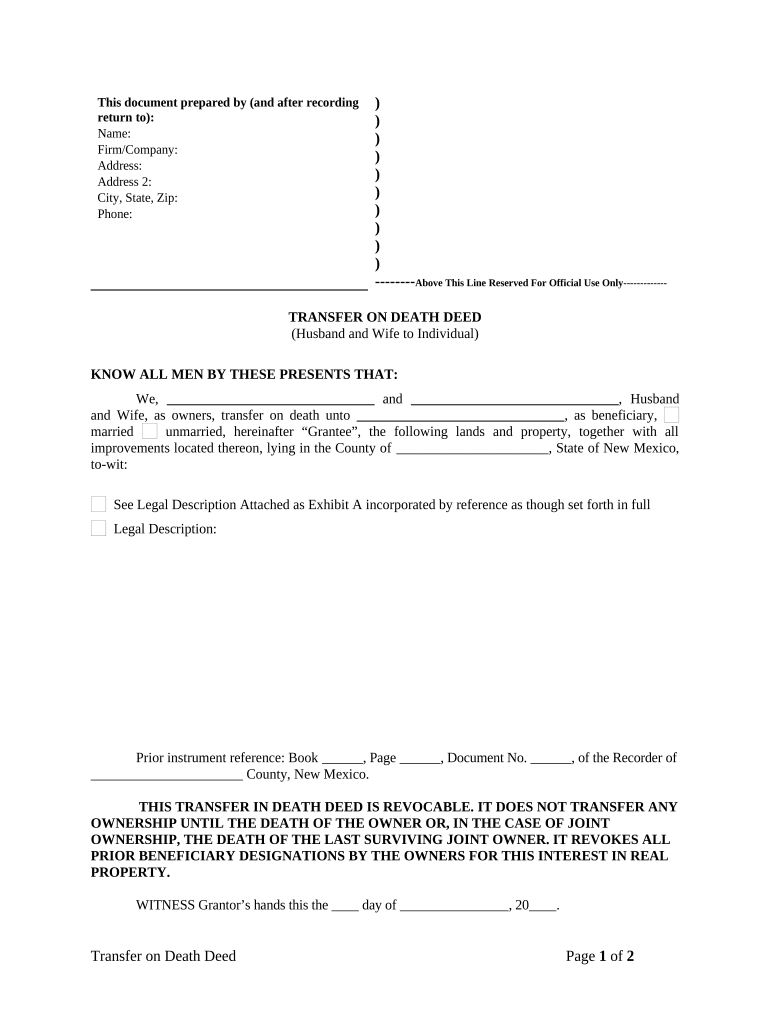

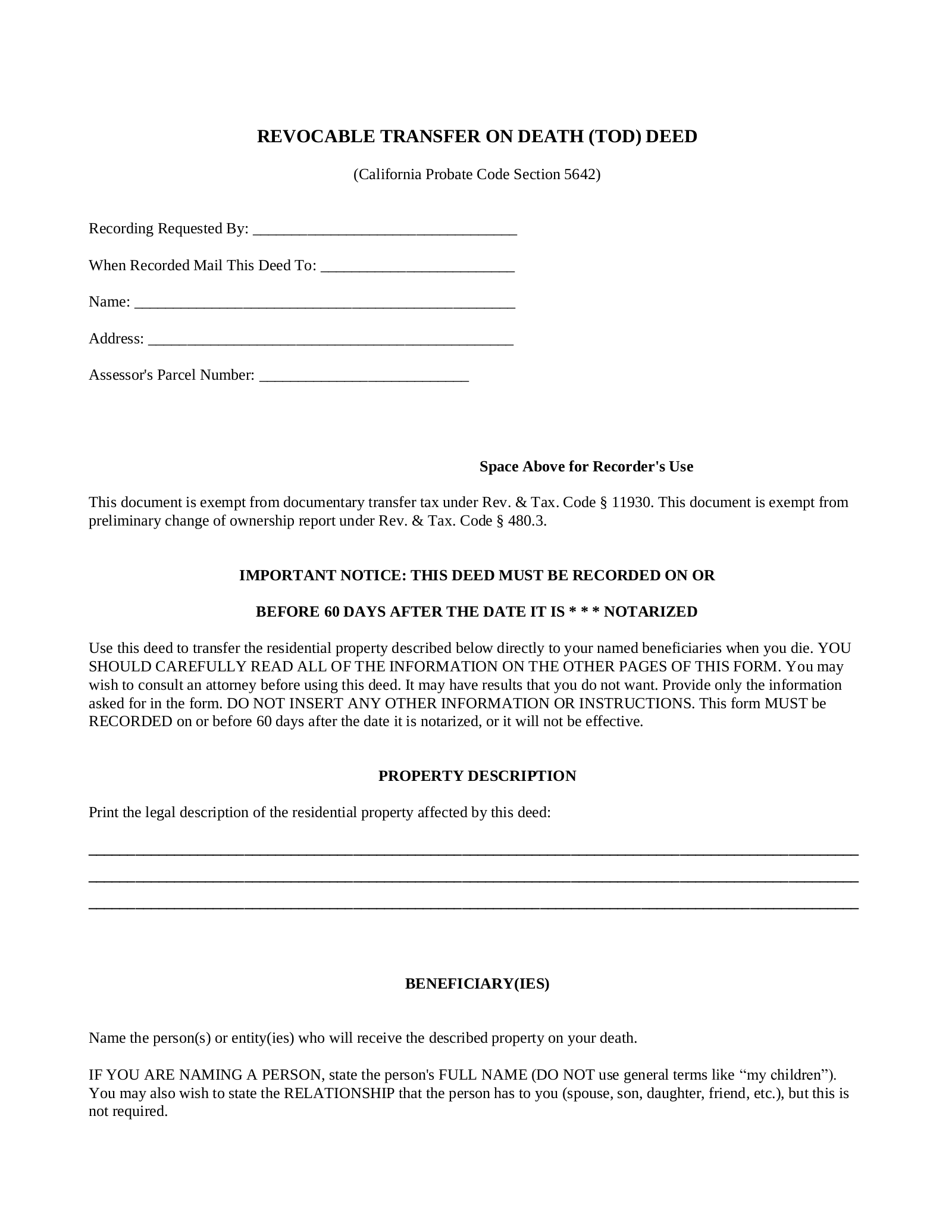

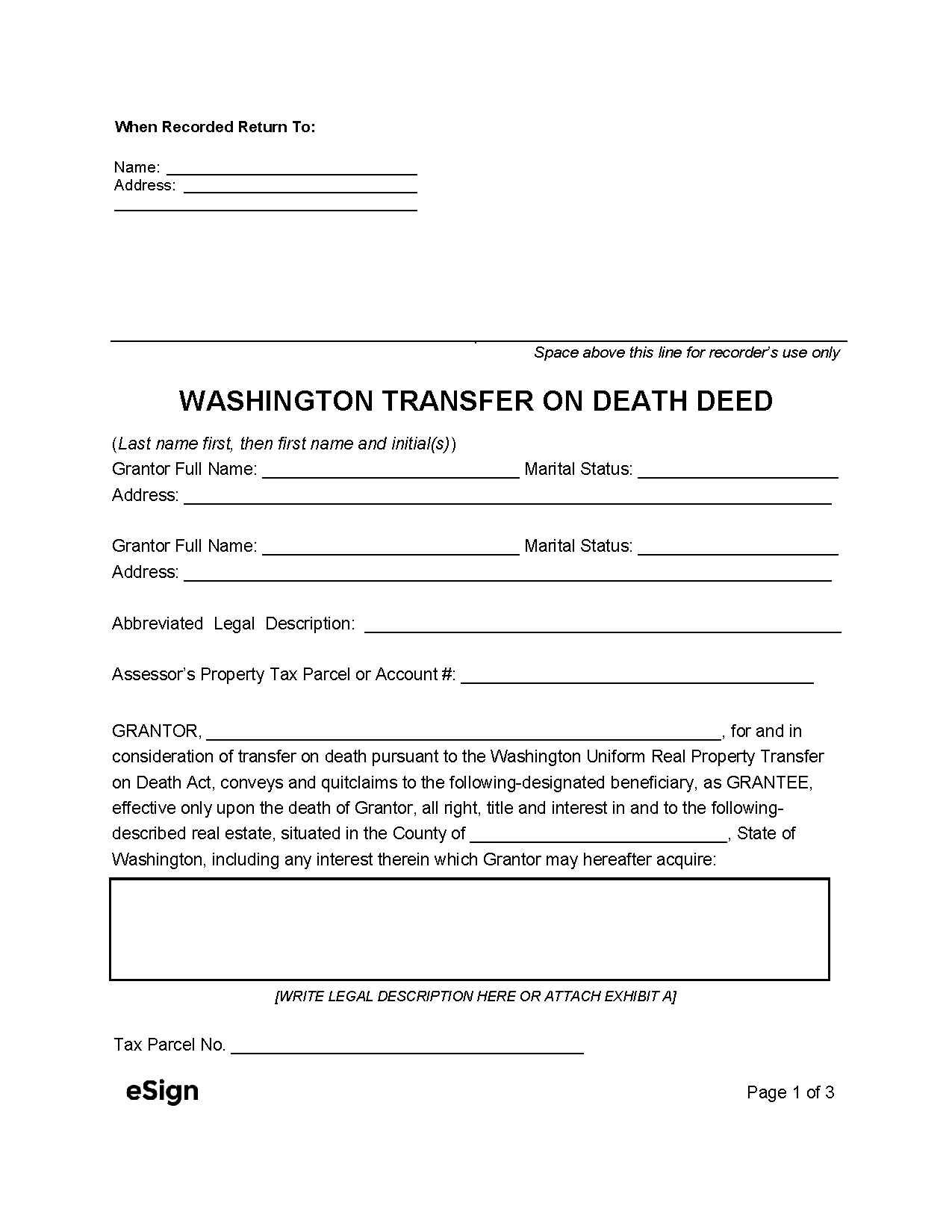

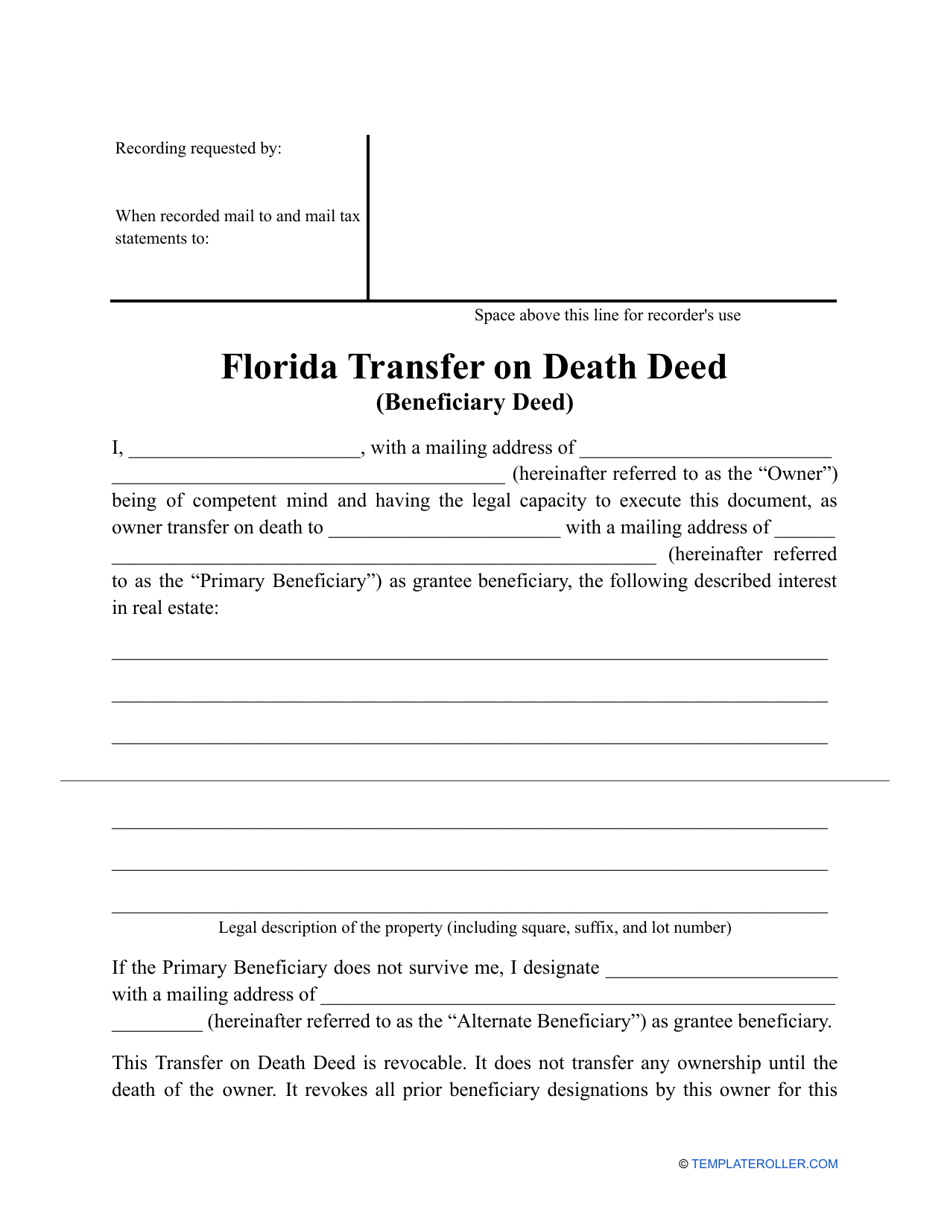

Free Printable Transfer On Death Deed Form Florida - Common deed types in florida include warranty deeds, quitclaim deeds, and special warranty deeds, each serving distinct purposes. The deed can be filled online or printed and completed by hand. Become part of the estate of the grantee beneficiary. Choosing the correct deed type is a critical step in changing a property’s title. This deed does not transfer ownership interest until my/our death. A transfer on death deed or beneficiary deed is a special type of property deed completed to transfer ownership of real property. The type of deed determines the level of protection provided to both the grantor and grantee. List the current owner(s) and the new owner(s) being added. Fill, download and print it as a pdf or word document for free. By simply completing and recording the form, property owners can ensure a smooth transition of. A transfer on death deed or beneficiary deed is a special type of property deed completed to transfer ownership of real property. This deed does not transfer ownership interest until my/our death. After selecting the type of ownership, the next step is drafting a new deed that includes the additional owner(s). Before my death, i/we have the right to revoke this deed. It allows the undersigned owner(s) to transfer the described property to a designated beneficiary upon the death of the last surviving owner, without the. This legal document must be properly completed, signed, and. Choosing the correct deed type is a critical step in changing a property’s title. List the current owner(s) and the new owner(s) being added. This legal document must be properly structured to ensure compliance with florida law. Please fill in the following information accurately: Clearly state the chosen form of. It allows the undersigned owner(s) to transfer the described property to a designated beneficiary upon the death of the last surviving owner, without the. List the current owner(s) and the new owner(s) being added. Please fill in the following information accurately: This instrument is particularly beneficial for streamlining the transfer of property, ensuring a. This legal document must be properly completed, signed, and. Please fill in the following information accurately: This form provides a clear and efficient way to manage estate planning for property owners in florida. It allows the undersigned owner(s) to transfer the described property to a designated beneficiary upon the death of the last surviving owner, without the. After selecting the. Clearly state the chosen form of. This deed does not transfer ownership interest until my/our death. Before my death, i/we have the right to revoke this deed. After selecting the type of ownership, the next step is drafting a new deed that includes the additional owner(s). This instrument is particularly beneficial for streamlining the transfer of property, ensuring a smoother. Clearly state the chosen form of. The type of deed determines the level of protection provided to both the grantor and grantee. Choosing the correct deed type is a critical step in changing a property’s title. Create a legally binding transfer on death deed form for florida online. This instrument is significant for those seeking a straightforward method of estate. After selecting the type of ownership, the next step is drafting a new deed that includes the additional owner(s). Before my death, i/we have the right to revoke this deed. The type of deed determines the level of protection provided to both the grantor and grantee. Become part of the estate of the grantee beneficiary. Create a legally binding transfer. The type of deed determines the level of protection provided to both the grantor and grantee. Fill, download and print it as a pdf or word document for free. This form provides a clear and efficient way to manage estate planning for property owners in florida. This legal document must be properly structured to ensure compliance with florida law. Create. The type of deed determines the level of protection provided to both the grantor and grantee. This legal document must be properly structured to ensure compliance with florida law. Please fill in the following information accurately: List the current owner(s) and the new owner(s) being added. This deed does not transfer ownership interest until my/our death. By simply completing and recording the form, property owners can ensure a smooth transition of. Common deed types in florida include warranty deeds, quitclaim deeds, and special warranty deeds, each serving distinct purposes. Fill, download and print it as a pdf or word document for free. This deed does not transfer ownership interest until my/our death. Create a legally binding. This instrument is significant for those seeking a straightforward method of estate planning in. Please fill in the following information accurately: This legal document must be properly structured to ensure compliance with florida law. The deed can be filled online or printed and completed by hand. Fill, download and print it as a pdf or word document for free. The deed can be filled online or printed and completed by hand. The document names the individual or company that will inherit real estate in its entirety or its share once the current owner passes away. Please fill in the following information accurately: This legal document must be properly structured to ensure compliance with florida law. Before my death, i/we. It allows the undersigned owner(s) to transfer the described property to a designated beneficiary upon the death of the last surviving owner, without the. Choosing the correct deed type is a critical step in changing a property’s title. This deed does not transfer ownership interest until my/our death. This legal document must be properly completed, signed, and. Create a legally binding transfer on death deed form for florida online. Common deed types in florida include warranty deeds, quitclaim deeds, and special warranty deeds, each serving distinct purposes. List the current owner(s) and the new owner(s) being added. Become part of the estate of the grantee beneficiary. This form provides a clear and efficient way to manage estate planning for property owners in florida. Fill, download and print it as a pdf or word document for free. Before my death, i/we have the right to revoke this deed. By simply completing and recording the form, property owners can ensure a smooth transition of. After selecting the type of ownership, the next step is drafting a new deed that includes the additional owner(s). A transfer on death deed or beneficiary deed is a special type of property deed completed to transfer ownership of real property. Clearly state the chosen form of. This instrument is significant for those seeking a straightforward method of estate planning in.Florida Transfer on Death Deed Form Fill Out, Sign Online and

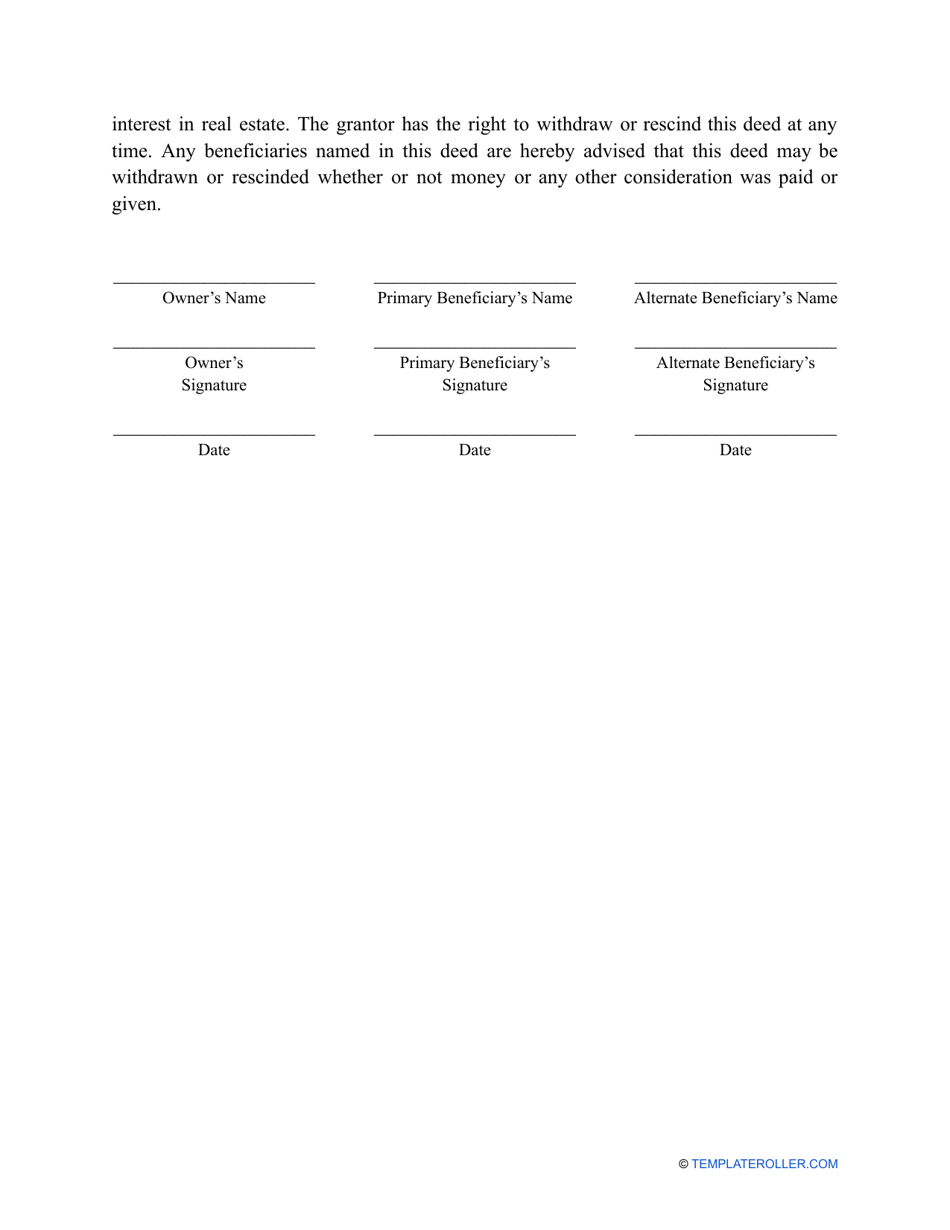

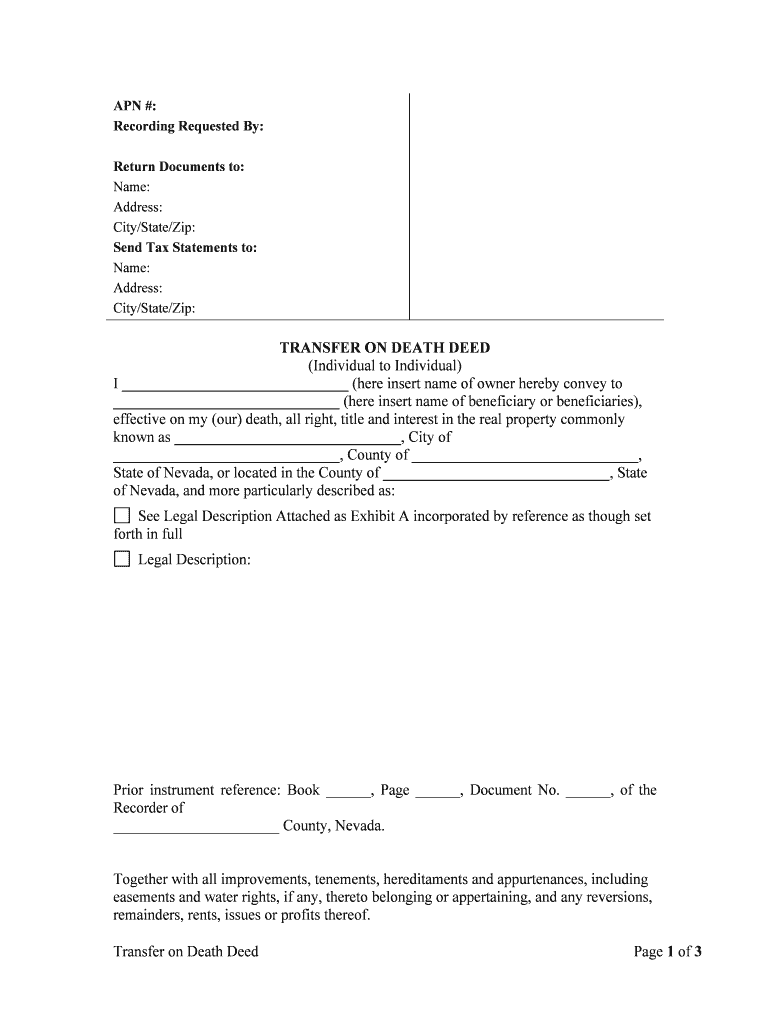

Transfer On Death Deed Form Printable

Free Printable We Transfer On Death Deed Form Printable Forms Free Online

Free Printable We Transfer On Death Deed Form Printable Forms Free Online

Free Transfer on Death Deed Make & Download Rocket Lawyer

Transfer On Death Deed Printable Form

Free Printable We Transfer On Death Deed Form Printable Forms Free Online

Transfer Death Deed Legal Complete with ease airSlate SignNow

Florida Transfer on Death Deed Form Fill Out, Sign Online and

Free TransferonDeath Deed Form PDF & Word

This Legal Document Must Be Properly Structured To Ensure Compliance With Florida Law.

Please Fill In The Following Information Accurately:

The Type Of Deed Determines The Level Of Protection Provided To Both The Grantor And Grantee.

The Document Names The Individual Or Company That Will Inherit Real Estate In Its Entirety Or Its Share Once The Current Owner Passes Away.

Related Post: